Credit reporting is a system that tracks individuals’ financial histories, providing insights into borrowing and repayment behaviors. It plays a crucial role in assessing creditworthiness for loans, mortgages, and other financial decisions; Understanding credit reporting is essential for maintaining financial health and ensuring accuracy in personal records. This guide explores the fundamentals of credit reporting, including how it works, its importance, and how to manage your credit profile effectively.

What is a Credit Report?

A credit report is a detailed document containing your personal financial information and credit history. It includes personal details, credit accounts, payment history, public records, and inquiries.

This report helps lenders assess your creditworthiness and determine loan approvals and interest rates. By law, you’re entitled to one free copy annually from each major credit bureau through AnnualCreditReport.com. Monitoring your credit report regularly helps ensure accuracy and detect potential fraud.

The Importance of Credit Reports

Credit reports are vital for lenders to evaluate your financial reliability and determine loan approvals or interest rates.

They provide a comprehensive view of your credit history, helping lenders assess risk and make informed decisions.

Regularly reviewing your credit report ensures accuracy, detects fraud, and helps maintain good financial health.

It also empowers you to understand your financial standing and make informed decisions about borrowing and credit management.

Who Uses Credit Reports?

Credit reports are primarily used by lenders and creditors to assess loan eligibility and interest rates.

Employers, landlords, and insurance companies may also review credit reports to evaluate reliability and responsibility.

Additionally, individuals can access their own reports to monitor financial health, detect errors, or identify signs of identity theft.

Regularly checking your credit report helps ensure accuracy and supports better financial decision-making.

Credit Bureaus: An Overview

Credit bureaus, such as Equifax, Experian, and TransUnion, collect and manage credit data to provide reports and scores. They play a key role in financial assessments and decisions.

The Three Major Credit Bureaus

The three major credit bureaus are Equifax, Experian, and TransUnion. Each collects and maintains consumer credit data to generate reports and scores. While they operate similarly, slight differences exist in their focus and services. Equifax and TransUnion are known for their comprehensive credit histories, while Experian offers additional identity theft protection tools. These bureaus play a critical role in financial assessments, influencing loan approvals and interest rates. Their websites provide access to free reports and monitoring services, empowering consumers to manage their credit profiles effectively.

How Credit Bureaus Collect Information

Credit bureaus gather data from various sources, including lenders, creditors, and public records. They compile information on payment history, debt levels, credit accounts, and public records like bankruptcies or foreclosures. This data is used to create detailed credit reports and calculate credit scores. Regular updates from lenders ensure the information remains accurate and current, helping bureaus provide reliable insights into consumer creditworthiness. This process is essential for fair and informed lending decisions, benefiting both consumers and financial institutions alike.

Differences Between the Major Credit Bureaus

While the three major credit bureaus—Equifax, Experian, and TransUnion—share similarities, they differ in how they collect and weigh data. Equifax focuses on historical data and public records, while Experian emphasizes alternative credit data. TransUnion offers more comprehensive reporting, including rental payments. Each bureau may calculate credit scores slightly differently, and discrepancies in data can lead to variations in credit reports and scores across bureaus, highlighting the importance of monitoring all three for accuracy and consistency.

Understanding Your Credit Score

Your credit score, typically ranging from 300 to 850, reflects your financial health and creditworthiness. It helps lenders assess risk and determine loan eligibility and terms.

What is a Credit Score?

A credit score is a three-digit number calculated based on your credit history, reflecting your financial health and creditworthiness. Ranging from 300 to 850, it helps lenders assess risk and determine loan eligibility, interest rates, and terms. Higher scores indicate better credit behavior and may qualify you for lower interest rates and favorable terms. A good credit score can significantly impact your financial opportunities and stability, making it a critical component of your financial profile.

How is a Credit Score Calculated?

Your credit score is calculated using data from your credit report, focusing on payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Each factor has a different weight, with payment history and credit utilization being the most influential. The FICO scoring model, widely used, assigns scores ranging from 300 to 850. Higher scores indicate better financial habits and lower risk for lenders, helping you qualify for better loan terms and lower interest rates.

Factors that Affect Your Credit Score

Your credit score is influenced by several key factors, including payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Payment history and credit utilization have the most significant impact, as they reflect your ability to manage debt responsibly. A longer credit history and a diverse mix of credit types can also improve your score, while excessive inquiries or recent accounts may lower it. These factors help lenders assess your financial reliability and creditworthiness.

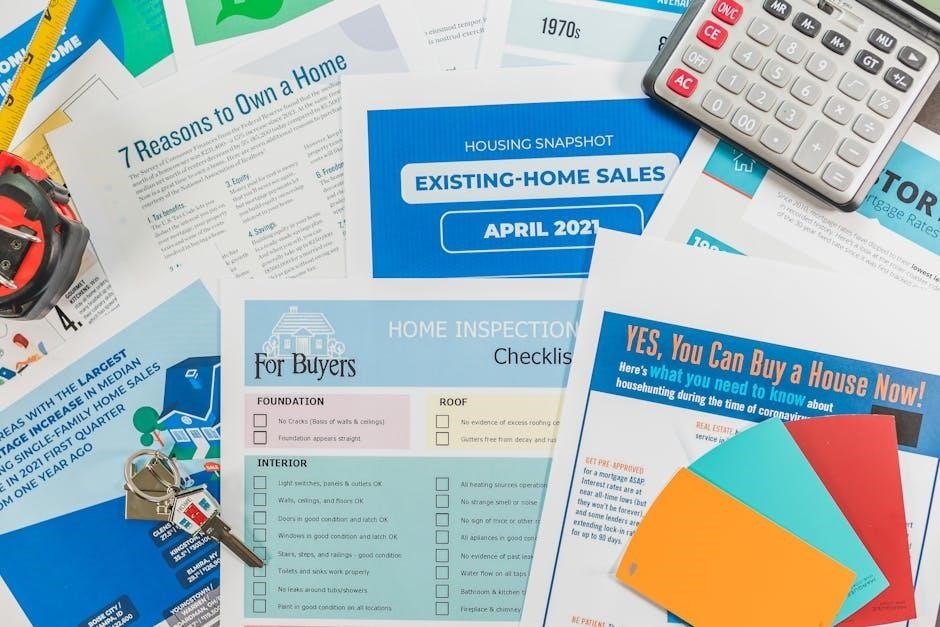

Obtaining Your Credit Report

Obtaining your credit report is straightforward. You can request it annually for free from the three major bureaus or access it through your credit card issuer.

How to Request Your Annual Credit Report

To request your annual credit report, visit AnnualCreditReport.com, the authorized source for free reports. You can access one report per year from each of the three major credit bureaus—Equifax, Experian, and TransUnion. Create an account, provide personal and identification details, and select the reports you wish to obtain. Reports are available instantly online as downloadable PDFs. For those without internet access, reports can also be requested by phone or mail, though this may take longer. Ensure your information is accurate to avoid delays, and verify the website’s security before submitting sensitive data.

Methods to Obtain Your Credit Report

You can obtain your credit report through three primary methods: online, by phone, or by mail. Online requests are the most convenient, typically processed instantly through official credit bureau websites. Phone requests involve calling the bureau directly, while mail requests require sending a written application with proper identification. Each method requires verification of personal details, such as Social Security number and address. Processing times vary, with online being the fastest and mail taking the longest. Always ensure you use secure, official channels to protect your information.

Information Included in Your Credit Report

Your credit report contains detailed personal and financial information. It includes personal details like your name, address, Social Security number, and employment history. Credit history lists accounts, balances, payment habits, and credit inquiries. Public records may show bankruptcies, foreclosures, or tax liens. Inquiries display who has accessed your report. The report also includes account status, credit limits, and payment history, providing a comprehensive view of your financial behavior and creditworthiness. This data helps lenders assess risk and make informed decisions.

Monitoring Your Credit Report

Monitoring your credit report involves regularly reviewing your financial history to ensure accuracy, detect errors, and identify potential fraud. It helps maintain good credit health and security.

Why You Should Regularly Check Your Credit Report

Regularly checking your credit report is essential for maintaining financial health. It helps detect errors, inaccuracies, or signs of identity theft, such as unauthorized accounts or inquiries. Monitoring ensures your credit history remains accurate and up-to-date, which is crucial for maintaining a good credit score. By staying informed, you can address issues promptly, prevent fraud, and make better financial decisions. Regular checks also help you understand how lenders view your creditworthiness, empowering you to improve your financial standing over time.

How to Monitor Your Credit Report Effectively

To monitor your credit report effectively, start by setting up automated alerts for any changes, such as new accounts or inquiries. Regularly review your report from all three bureaus to catch discrepancies. Use online tools or apps that track changes and provide real-time updates. Ensure you understand each section, including personal info, credit history, and public records. Flag and dispute errors promptly to maintain accuracy. Consistent monitoring helps protect against fraud and ensures your financial data remains secure and up-to-date;

Tools and Resources for Credit Monitoring

Utilize free tools like Credit Karma and Credit Sesame for daily credit score updates and alerts. Major bureaus offer paid monitoring services with real-time updates and fraud alerts. Identity theft protection services like LifeLock provide advanced monitoring. Free annual reports from AnnualCreditReport.com help spot errors. Mobile apps like TrueCredit and PrivacyGuard offer personalized tracking. These resources empower you to stay proactive, detect fraud early, and maintain control over your financial health.

Understanding Credit Report Components

Your credit report includes personal details, credit history, public records, and inquiries. It provides a comprehensive view of your financial behavior and creditworthiness.

Personal Information

Your credit report includes personal details like your name, Social Security number, birthdate, current and past addresses, phone numbers, and employment information. This section helps verify your identity and ensures accuracy in reporting. It is not used to calculate your credit score but is essential for lenders to confirm who you are before approving credit. Errors here should be corrected promptly to avoid issues with credit applications or fraud concerns.

Credit History

Your credit history details your past and current credit accounts, including loans, credit cards, and mortgages. It shows account balances, credit limits, payment history, and how long accounts have been open. Lenders use this information to assess your creditworthiness and predict future payment behavior. Positive history, like on-time payments, strengthens your credit profile, while late payments or defaults can harm it. Accurate credit history is vital for fair credit evaluations and maintaining good financial health.

Public Records

Public records on a credit report include legal information such as bankruptcies, foreclosures, tax liens, and court judgments. These records indicate financial distress and can significantly lower your credit score. They are collected from government sources and court documents, providing insight into legal actions that may impact your financial stability; Public records remain on your report for 7–10 years, depending on the type, and are reviewed by lenders to assess risk when approving credit or loans.

Inquiries

Inquiries on a credit report reflect instances when your credit information was accessed. There are two types: hard inquiries and soft inquiries. Hard inquiries occur when lenders review your credit to approve loans or credit applications and can temporarily lower your score. Soft inquiries, such as those for promotional offers or account monitoring, do not affect your score. Monitoring inquiries helps ensure no unauthorized access to your credit data, protecting against fraud and errors in your report.

Disputing Errors on Your Credit Report

Disputing errors on your credit report is crucial for ensuring accuracy and fairness. It allows you to challenge and correct inaccuracies that may harm your credit score.

How to Identify Errors on Your Credit Report

Identifying errors on your credit report involves carefully reviewing each section for accuracy. Check personal details, account information, and payment history for any discrepancies. Look for unauthorized accounts, incorrect balances, or late payment marks. Verify that all inquiries are legitimate and familiar. Ensure public records, like bankruptcies or liens, are accurate and up-to-date. Any unfamiliar or incorrect information could indicate errors or fraud, requiring immediate attention to protect your credit standing.

The Process of Disputing Credit Report Errors

Disputing errors on your credit report involves submitting a formal request to the credit bureau. Start by identifying the error and gathering supporting documents. File your dispute online, by mail, or via phone, depending on the bureau’s process. Clearly explain the issue and provide evidence. The bureau typically has 30 days to investigate. If the error is confirmed, it will be corrected or removed. Keep copies of your dispute and follow up if necessary to ensure resolution and update your credit record accurately.

Steps to Resolve Disputes

Resolve disputes by first submitting a clear, detailed request to the credit bureau. Include copies of documents supporting your claim. After filing, monitor the investigation process, which typically takes 30 days. Review the results once complete. If the dispute is resolved in your favor, request an updated credit report. If unresolved, you can add a statement to your report explaining your position. Follow up with the bureau or seek further assistance if needed to ensure the issue is fully addressed and corrected promptly.

Building and Maintaining Good Credit

Establishing good credit requires consistent on-time payments, low credit utilization, and avoiding unnecessary inquiries. Monitor your credit report regularly and seek professional advice to maintain a healthy financial profile.

Best Practices for Building Credit

Building credit effectively involves several key strategies. Start by ensuring accuracy on your credit report and making all payments on time. Keep credit utilization below 30% to demonstrate responsible borrowing habits. Avoid applying for multiple credit lines in a short period, as this can negatively impact your score. Monitor your credit score regularly to track progress and address any issues promptly. Lastly, consider securing a credit-builder loan or becoming an authorized user on someone else’s account to establish a positive history over time.

The Impact of On-Time Payments

On-time payments significantly boost your credit score by demonstrating financial responsibility. Payment history accounts for a large portion of your score, with consistent punctuality improving creditor trust. Over time, this establishes a positive credit history, enhancing your ability to secure loans and better interest rates. Late payments, even by a few days, can lower your score and remain on your report for up to seven years. Prioritizing timely payments is essential for maintaining strong credit health and long-term financial stability.

Managing Credit Utilization

Credit utilization, the percentage of available credit used, significantly impacts your credit score. Keeping it below 30% is recommended, with lower percentages being even better. High utilization can indicate financial strain, harming your score. Strategies like paying down debt, requesting credit limit increases, or opening new credit (carefully) can help lower your ratio. Monitoring and managing this balance effectively is crucial for maintaining a healthy credit profile and improving your overall financial standing.

Credit Reporting and Identity Theft

Credit reporting plays a key role in detecting identity theft by monitoring unusual account activity and fraudulent inquiries, helping protect your financial health and security.

How to Protect Yourself from Identity Theft

Protect yourself by monitoring your credit report regularly, freezing your credit, and using strong, unique passwords. Enable two-factor authentication for added security. Shred sensitive documents and avoid sharing personal information online. Be cautious of phishing attempts and verify suspicious emails or calls. Encrypt sensitive data and keep your devices updated with the latest security software. Educating yourself about identity theft tactics can help you stay ahead of potential threats and safeguard your financial identity.

Signs of Fraud on Your Credit Report

Unfamiliar accounts, unexpected inquiries, or sudden drops in your credit score may indicate fraud. Look for charges or loans you didn’t authorize, suspicious addresses or phone numbers linked to your accounts, or unexplained balances. Fraudulent activity often appears as hard inquiries from unknown sources or accounts opened in your name without your knowledge. Monitor for incorrect personal information, such as misspelled names or wrong Social Security numbers, which could signal identity theft.

What to Do if You Are a Victim of Identity Theft

If you suspect identity theft, act swiftly to protect your finances. First, contact the three major credit bureaus to place a fraud alert or freeze your credit. This prevents further unauthorized access. Review your financial statements for unfamiliar transactions and report any discrepancies immediately. File a complaint with the Federal Trade Commission (FTC) and consider filing a police report for official documentation. Change all your passwords, enable two-factor authentication, and monitor your credit regularly for signs of fraud. Educate yourself on prevention strategies to avoid future incidents.

Legal Rights and Credit Reporting

Your legal rights protect you from inaccurate or unfair credit reporting practices. The FCRA ensures access to your reports, the right to dispute errors, and accountability for violations.

Overview of the Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law regulating consumer credit information. It ensures fairness, accuracy, and privacy in credit reporting practices. The FCRA grants consumers the right to access their credit reports, dispute errors, and restrict unauthorized access to their information. It also requires credit bureaus and lenders to maintain accurate records and disclose how credit information is used. This law protects consumers from misuse of their financial data and promotes transparency in credit decisions.

Your Rights Under the FCRA

Under the FCRA, consumers have the right to access their credit reports, dispute inaccuracies, and receive disclosures about how their credit information is used. You can request a free annual credit report from each major bureau and restrict unauthorized access to your reports. The FCRA also protects you from discrimination based on credit information and allows you to sue for damages if your rights are violated. These protections ensure transparency and fairness in how your credit data is handled.

How to File a Complaint

To file a complaint under the FCRA, start by contacting the Federal Trade Commission (FTC) online or by phone. Provide detailed information about the violation, including documents supporting your claim. The FTC will investigate and may take enforcement action. You can also file a lawsuit in federal court if the violation causes harm. Additionally, you can submit complaints to the Consumer Financial Protection Bureau (CFPB) for further assistance. Always keep records of your interactions and submissions.

Additional Resources

Explore official credit bureau websites, FTC guidelines, and CFPB resources for comprehensive credit reporting information and tools to manage your financial health effectively.

Free Annual Credit Report

The Fair Credit Reporting Act (FCRA) entitles you to one free credit report annually from each of the three major bureaus. Visit AnnualCreditReport.com to request yours without fees or obligations. This service allows you to monitor your credit history, verify accuracy, and detect potential errors or fraud. Regularly reviewing your report helps ensure financial health and security. It’s a crucial tool for maintaining good credit and making informed financial decisions.

How Often Can You Check Your Credit Report?

You can check your credit report as often as you like without harming your credit score, but access frequency varies. The FCRA guarantees one free report annually from each bureau via AnnualCreditReport.com. Some services offer free weekly reports, while others provide monthly updates. Checking regularly helps monitor changes, detect errors, and prevent fraud. Spacing out requests across bureaus ensures year-round oversight. Regular monitoring is key to maintaining financial health and catching issues early.

Using Credit Reports for Financial Planning

Credit reports are invaluable tools for financial planning. They provide insights into your debt, payment history, and credit utilization, helping you identify areas for improvement. By reviewing your report, you can set realistic goals, such as reducing debt or improving your credit score. This data also aids in planning for major purchases, like loans or mortgages. Regularly monitoring your report ensures you stay on track, avoid financial pitfalls, and make informed decisions to achieve long-term financial stability and success.